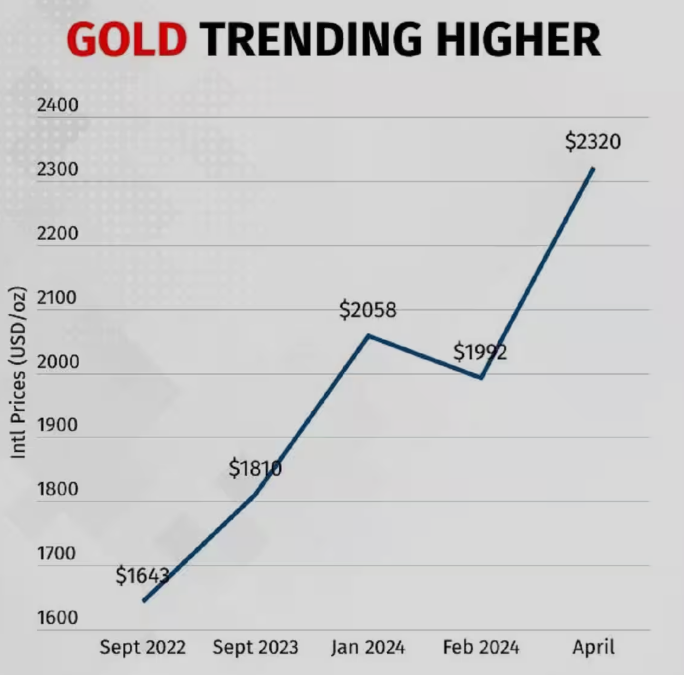

Gold prices in India have skyrocketed, reaching an all-time high of ₹87,210 per 10 grams of 24K gold. Since February 1, 2025, the metal’s value has been on a relentless upward climb, making investors and market watchers take notice. But what’s fueling this golden rush?

For starters, global economic uncertainties have investors flocking to gold as a haven. With inflation concerns, shaky stock markets, and ongoing geopolitical tensions (looking at you, trade wars, and election turmoil), people are hedging their bets with something timeless—gold. Additionally, central banks worldwide are stockpiling gold reserves, further driving up demand. Throw in a weakening rupee against the dollar, and you’ve got the perfect storm for soaring gold prices.

Investment Strategies Amidst Soaring Gold Prices

So, the million-rupee question: Is it too late to invest? Not necessarily. While gold is trading at record highs, there are still smart ways to get in on the action.

- Physical Gold: The traditional route—buying gold jewelry, coins, or bars—remains a solid choice. However, keep in mind the added costs of making charges and storage.

- Gold ETFs & Mutual Funds: If you prefer a hassle-free investment, exchange-traded funds (ETFs) and gold mutual funds let you own gold without the headache of safekeeping.

- Sovereign Gold Bonds (SGBs): Issued by the government, these offer interest on top of gold’s price appreciation—essentially, a double win.

- Gold Mining Stocks: Want to go beyond just owning gold? Investing in mining companies gives you exposure to the industry, with the potential for high returns if gold prices continue rising.

Risks and Rewards: Navigating the Volatile Gold Market

Gold is glittering bright right now, but let’s not forget that what goes up can come down. Here’s what you need to consider:

Rewards:

- Safe-haven assets during economic instability.

- Inflation hedge—gold has historically preserved purchasing power.

- High liquidity—you can sell it almost anytime, anywhere.

Risks:

- Market Corrections: Prices could dip if global conditions stabilize.

- No Passive Income: Unlike stocks or bonds, gold doesn’t generate interest or dividends.

- Storage Costs & Purity Concerns: If you’re buying physical gold, you need to ensure security and authenticity.

The key? Diversify your investments—don’t go all in on gold, no matter how shiny it looks.

Expert Predictions: The Future of Gold Beyond 2025

Will gold keep climbing, or is this a temporary bubble? Experts are divided.

- Bullish View: Some analysts predict that if inflation remains high and central banks continue hoarding gold, we could see prices touch ₹95,000 per 10 grams by the end of 2025.

- Bearish View: On the flip side, if global economies stabilize and interest rates rise, gold demand might cool off, leading to a correction in prices.

Market veterans suggest keeping an eye on U.S. Federal Reserve policies, inflation data, and global trade trends, as they will heavily influence gold’s trajectory.

Practical Tips for New Gold Investors

Thinking of jumping into gold investment? Here’s what you need to keep in mind:

- Start Small: If you’re new, don’t splurge all at once. Buy in small quantities to average out price fluctuations.

- Go Digital: Gold ETFs and Sovereign Gold Bonds are safer and more cost-effective than physical gold.

Also Read: What Does Trump’s End to Birthright Citizenship Mean for Future Generations?

- Check Purity & Certification: If buying physical gold, only purchase hallmarked jewelry or bars to ensure authenticity.

- Understand Tax Implications: Gold profits are taxable in India—short-term gains are taxed as per your income slab, while long-term gains (after 3 years) attract a 20% tax with indexation benefits.

Final Thoughts: Is It the Right Time to Buy Gold?

Gold’s meteoric rise in 2025 is both exciting and nerve-wracking. While prices are at record highs, there’s still room for growth—especially if economic uncertainties persist. However, smart investors should approach with caution, diversify their portfolios, and avoid FOMO-driven decisions.

Whether you’re investing in gold bars, ETFs, or mining stocks, one thing’s for sure—this precious metal isn’t losing its luster anytime soon!